RSA Retail Bonds are an option for those seeking that little extra interest from their strained savings. Effectively, you are lending the government money on a short term basis of 2, 3 and 5 year options where the interest is fixed and you are guaranteed your money back at the end of the term that you choose.

Interest rates are on the rise with money market rates yielding between 5 and 6%.

Money market rates are available to those who have the means to qualify. The bank normally requires a minimum balance or a fixed period to earn the higher interest rates found in the money market.

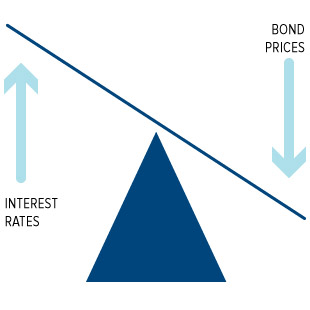

The changes in interest rates affect the RSA Retails Bond rates. Generally speaking, as interest rates fall, bond rates rise. The converse applies.

RSA Retail Bonds are very competitive

The rates currently on offer are higher than the rates offered by the money market. There are no fees or costs so the rate is clean. Pensioners over 65 can opt to have the interest paid monthly and if you elect the 5 year option you can opt out after 12 months paying a penalty.

| 2 Year Fixed Rate | 9.25% |

| 3 Year Fixed Rate | 9.50% |

| 5 Year Fixed Rate | 11.00% |

So where can you invest in a RSA Retail Bond

Payments can be through the following means – Any branch of the South African Post Office – Internet Banking – Direct deposit at the bank – Directly at National Treasury in Pretoria