What are they?

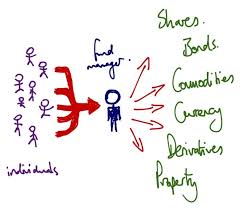

You get to invest for as little as a few hundred rand into a large investment pool which is managed by a fund manager according to a specific objective. The investment is priced in units (hence the name) based on the value of the fund. There are around 1000 to choose from locally and thousands more globally.

They are regulated

They are carefully regulated and the fund is held in a trust and is not owned by the fund manager or service provider which offers protection over your investment.

Unit Trusts are used in most investments such as pension funds, endowment policies and retirement annuities in varying combinations.

They are easily accessible

The main benefit is their liquidity. They can be cashed in at any time and the fund manager has to pay you the unit value at the closing price on the day you sell. This provides easy access to your funds when you need them.

They provide access to different asset classes

Let’s say that you want to invest in property. You can buy a building and manage the project on your own with all the challenges that come with it. Alternatively, you can invest in a unit trust which focuses on property portfolios managed by experts. You can sell this at any time and you don’t have the hassle factor whilst you are investing. Selling is easy as you get the day’s closing price of the unit, whereas, a property takes a lot longer as you wait for a willing buyer and then the long process of changing registration before getting your money.

They are cost effective

There are no fees applied to selling units, however, you do pay a fee to buy them and while you are invested the fund manager, administrator and advisor (if you used one) will all charge you whilst they are actively involved in the investment. These fees are normally a specific percentage of the value of your fund and are collected monthly from your investment.

They provide for rand cost averaging

Unit trusts are price per unit the value of which moves up and down relative to the assist that they are invested in. So in a downturn the units are cheaper and if you are buying on a monthly basis you simply get more lints for the same price.If and when the value increase you realise the value. The converse applies in a bull market where units are more expensive.

Unit trusts provide access to sophisticated investments with ease and protection. However, the choice of funds needs homework and often needs the help of an financial advisor.